And because some SDIRAs like self-directed conventional IRAs are issue to essential minimum distributions (RMDs), you’ll ought to approach ahead in order that you've got plenty of liquidity to fulfill the rules established from the IRS.

Opening an SDIRA can present you with usage of investments Ordinarily unavailable via a financial institution or brokerage organization. Below’s how to begin:

An SDIRA custodian differs because they have the right staff members, abilities, and ability to maintain custody of the alternative investments. The initial step in opening a self-directed IRA is to find a provider that is specialised in administering accounts for alternative investments.

IRAs held at financial institutions and brokerage firms supply limited investment solutions to their clients mainly because they do not need the experience or infrastructure to administer alternative assets.

Choice of Investment Options: Ensure the supplier lets the kinds of alternative investments you’re interested in, including real estate property, precious metals, or non-public fairness.

Greater Expenses: SDIRAs frequently feature higher administrative expenditures in comparison with other IRAs, as sure elements of the executive process cannot be automated.

Right before opening an SDIRA, it’s vital that you weigh the opportunity advantages and drawbacks depending on your specific fiscal objectives and hazard tolerance.

Complexity and Accountability: By having an SDIRA, you've got much more Command above your investments, but You furthermore may bear much more accountability.

SDIRAs tend to be utilized by hands-on buyers who will be ready to take on the hazards and duties of selecting and vetting their investments. Self directed IRA accounts can also be perfect for traders who may have specialized knowledge in a distinct segment sector which they want to invest in.

The main SDIRA procedures within the IRS that traders require to understand are investment limits, disqualified individuals, and prohibited transactions. Account holders must abide by SDIRA regulations and rules in order to protect the tax-advantaged position of their account.

Lots of traders are shocked to master that making use of retirement cash to take a position in alternative assets has long been feasible considering that 1974. On the other hand, most brokerage firms and banking companies concentrate on supplying publicly traded securities, like stocks and bonds, because they deficiency the infrastructure and know-how to deal with privately held assets, for instance real estate property or personal equity.

Have the liberty to speculate in Virtually any kind of asset which has a danger profile that fits your investment tactic; including assets that have the possible for a better amount of return.

Homework: It is really called "self-directed" to get a cause. Using an SDIRA, you happen to be fully chargeable for totally looking into and vetting investments.

Consequently, they have a tendency not to promote self-directed IRAs, which provide the pliability to invest in a very broader selection of assets.

Consider your Buddy is likely to be starting up the next Facebook or Uber? Having an SDIRA, you'll be able to spend money on triggers that you suspect in; and possibly love greater returns.

Nevertheless there are various benefits linked to an SDIRA, it’s not without the need of its very own downsides. A lot of the typical explanations why traders don’t opt for SDIRAs include:

Ease of Use and Know-how: A consumer-helpful System with on the web instruments to track your investments, submit documents, and handle your account is essential.

A self-directed see this IRA is undoubtedly an unbelievably highly effective investment car or truck, but it really’s not for everybody. Since the stating goes: with fantastic energy comes terrific accountability; and using an SDIRA, that couldn’t be much more accurate. Continue reading to discover why an SDIRA may well, or might not, be for yourself.

Purchaser Help: Look for a company that offers committed support, like access to well-informed specialists who will reply questions on compliance and IRS guidelines.

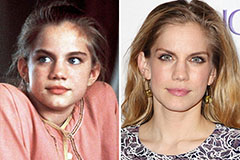

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!